7 Proven Ways to Find Undervalued Crypto Gems Before They Explode

Every cycle has its legends — the tokens that nobody is paying attention to until suddenly everyone is. They’re quiet, overlooked, sometimes even dismissed. And then one day, they erupt.

Those dramatic price moves aren’t random. They follow patterns. They follow human behavior. And most importantly, they follow data — data that appears long before the breakout happens.

Spotting undervalued crypto gems isn’t about luck. It’s a skillset grounded in understanding how markets misprice assets, how narratives form, and how early signals show themselves in both on-chain and off-chain activity.

Below are seven proven methods professionals use to find undervalued crypto gems early — with a subtle note on a tool that can help accelerate your research if you’re serious about doing this effectively.

1. Why Undervalued Crypto Gems Even Exist (And Why Most People Miss Them)

Crypto markets are emotional, fast-moving, and influenced heavily by narrative waves. This creates an environment where strong projects can remain undervalued simply because they haven’t entered the spotlight yet.

Quiet Projects Go Unnoticed

Most early-stage projects lack:

- Influencer hype

- Exchange listings

- Large marketing budgets

Yet they often have dedicated teams quietly building.

Retail Bias Causes Blind Spots

Retail investors chase what’s already moving.

By the time a token appears everywhere on social media, the early opportunity is gone.

Fundamentals Improve Before Price

A project can gain users, expand partnerships, and ship updates for months before the market catches on.

Your advantage is spotting that early.

2. Compare Market Cap vs Fully Diluted Valuation (FDV)

This single valuation lens helps filter out the majority of bad opportunities.

Market Cap Reflects Today

Only circulating supply matters here.

FDV Reveals Tomorrow

If a token has a tiny circulating supply but massive incoming unlocks, selling pressure could crush the price.

Healthy Undervalued Projects Often Have:

- Reasonable FDV

- Fair emissions

- Sustainable tokenomics

This ensures long-term potential rather than short-lived pumps.

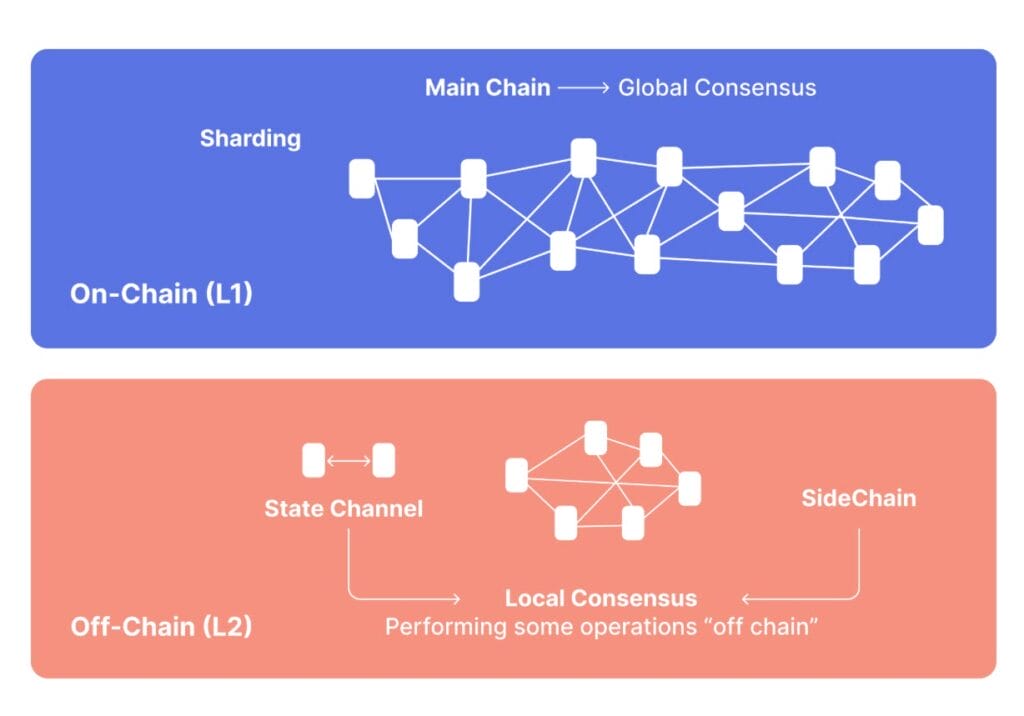

3. Use On-Chain Activity to Spot Momentum Early

On-chain data reveals what’s happening beneath the surface. It shows the behavior of real users, real liquidity, and real investors — long before hype builds.

Unique Wallet Growth

Steady increases in holders typically indicate legitimate interest.

Smart Money Accumulation

When experienced wallets begin accumulating quietly, it’s rarely random.

This is one area where specialized tools can help streamline your research.

For example:

The Crypto Underworld offers a simplified way for beginners to understand early DeFi activity and track lesser-known tokens before they expand to larger platforms. It doesn’t replace deep research — but it can help newer investors navigate early-stage DeFi with more confidence, especially when learning how to identify potential gems in their infancy.

Liquidity Depth & Bridging Patterns

Growing liquidity, cross-chain expansion, and balanced pool depth often signal a project preparing for larger exposure.

4. Do the Off-Chain Research Most Traders Ignore

Off-chain fundamentals often reveal the true strength of a project.

Team Track Record

A credible team is one of the strongest predictors of long-term viability.

GitHub Activity

Healthy projects have consistent commits and visible progress.

Roadmap Execution

Execution matters more than grand promises.

Solid teams deliver quietly, consistently, and without sensationalism.

5. Evaluate Token Utility and Ecosystem Fit

A token’s purpose determines its long-term value.

Real Utility Matters

Ask:

If this token disappeared tomorrow, would anything break?

If the answer is yes, the project has inherent value.

Ecosystem Momentum

Tokens aligned with strong sectors — AI, DePIN, RWAs, gaming infrastructure — tend to compound faster.

Meaningful Integrations

Look for partnerships with reputable ecosystems and real use cases, not superficial announcements.

6. Disqualify Red Flags Immediately

Even if a token looks undervalued, certain issues make it uninvestable.

🚩 High FDV Without Utility

Future dilution risk.

🚩 Large Unlock Cliffs

Heavy selling pressure ahead.

🚩 Anonymous Teams + No Audit

Too much risk for too little reward.

🚩 Marketing Over Development

A major red flag for long-term sustainability.

7. Build a Portfolio Strategy That Survives Volatility

Even the best gems won’t perform well without proper portfolio management.

Position Sizing

Small caps don’t require large allocations to deliver strong results.

Set Your Exit Strategy Before You Enter

Remove emotion from your decisions.

Allocate According to Volatility

Match your risk to the nature of the asset.

FAQs

What makes a token undervalued?

When its development, usage, or adoption significantly exceeds its current price.

Are low market cap coins always undervalued?

Not at all — fundamentals matter more than numbers.

How fast do undervalued tokens explode?

Some move fast; others develop quietly for months.

Can tools help identify gems earlier?

Yes — tools that simplify early-stage DeFi discovery can be helpful, especially for beginners.

Products / Tools / Resources

Below are helpful resources for identifying undervalued crypto gems more efficiently:

- The Crypto Underworld — A beginner-friendly system that teaches how to explore the DeFi market and spot early-stage tokens before they go mainstream. Ideal for new traders learning how to navigate DeFi, evaluate low-cost tokens, and understand early momentum signals.

- CoinGecko / CoinMarketCap — Market cap and tokenomics reference

- TokenUnlocks — Track unlock schedules

- Dune Analytics — Build custom on-chain dashboards

- Nansen / Arkham — Advanced wallet and inflow tracking for intermediate users

- GitHub & CryptoMiso — Developer activity monitoring